Accounting Services

As a business owner, your time is valuable.

Let us take care of your small business accounting & bookkeeping so you can focus on growing your business and serving your clients.

Accounting Services

As a business owner, your time is valuable.

Let us take care of your small business accounting & bookkeeping so you can focus on growing your business and serving your clients.

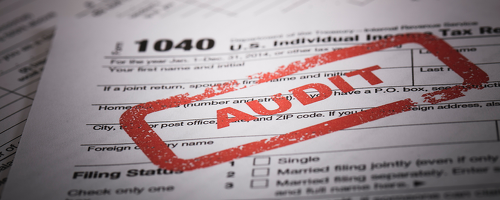

Here’s what we do for you each month or quarter:

- Post your transactions

- Reconcile your bank account

- Generate an income statement

- Generate a balance sheet

- Clean up your general ledger

- Provide unlimited consultations

Having us reconcile your account each month allows you to:

- Identify lost checks, deposits, or unauthorized transactions

- Detect and stop excess/unjustified bank charges

- Prevent theft from within your company

- Understand how your business is operating

- Manage cash flow for upcoming projects or economic changes

Preparing financial statements for your business enables you to:

- Track revenues, expenses, and compare to budgets

- Identify unusual transactions or expenses

- Determine tax liability

- Analyze cash flow strengths and weaknesses

- Spot trends in inventory, accounts receivable, or accounts payable

- Assess readiness for expansion and potential financing needs

- Provide timely financial reports to lenders and banks when necessary